The Most Intelligent Fraud Prevention Platform

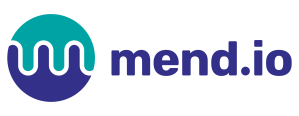

AFC Ecosystem

The Key Pillars of the AFC Ecosystem

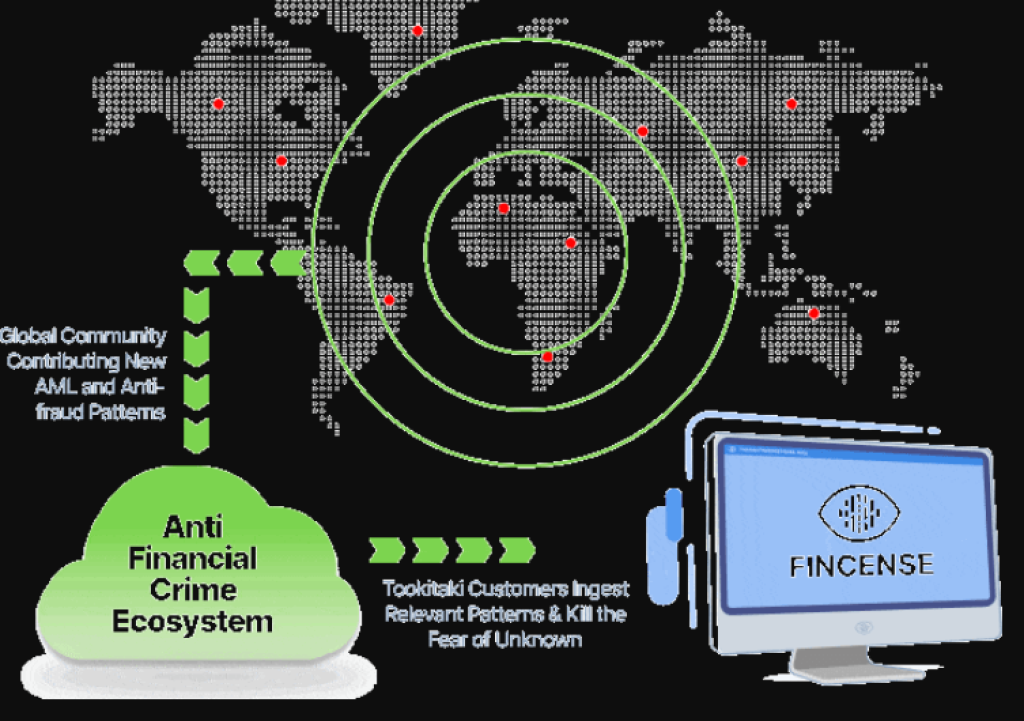

Typology Repository

A Combined Gaining Stage that gives admittance to key data from genuine monetary wrongdoing cases safely and secretly. It works under an Administration System that guarantees powerful survey instruments and recognizability.

AFC Network

A worldwide organization of Misrepresentation and Hostile to Tax evasion specialists that plan to mutually handle monetary wrongdoings by pooling their aggregate information. The individuals contribute new typologies that are assessed

Who Forms the AFC Network

The Anti-Financial Crime Ecosystem (AFC) is a tech-enabled community platform that connects financial experts across industries that share the common goal of collaborating to enhance their ability to protect against and prevent financial crime.

The members of the AFC Ecosystem are financial crime experts from:

- Financial Institutions: Banks, credit unions, and other financial service providers.

- Risk Advisory Firms: Companies specialising in risk management and financial crime prevention.

- Non-Profit Organisations: NGOs focused on financial integrity and security.

- Law Firms: Legal experts working against financial crime.

Advantages

Share Intelligence

Work together and recognize key dangers and target assets actually.

Build Resilient Programs

Foster coordinated and strong monetary wrongdoing consistence programs.

Stay Connected

Access an all inclusive resource to remain refreshed on new and arising dangers.

Showcase Your Voice

Assemble your presence in the powerful universe of monetary wrongdoing anticipation.

Participate in Programs

Take part in public and worldwide projects to handle monetary wrongdoing.

FinCense

Next-Gen AML and Fraud Prevention Solution

Meet FinCense – an end-to-end solution to meet your CDD, Screening and Transaction Monitoring needs

Stay Ahead of Evolving Fraud and AML Threats

Emerging Threats

New and refined misrepresentation examples and tax evasion procedures arise routinely, testing regular recognition frameworks.

Complex Networks

The worldwide idea of monetary exchanges adds intricacy to AML consistence and extortion identification endeavors.

Regulatory Demands

Uplifted administrative examination requests strong consistence methodologies and high level innovative arrangements.

Comprehensive | Accurate | Scalable

- Stay Ahead Of Threats Benefit from our Enemy of Monetary Wrongdoing (AFC) Ecosystem system, an interesting local area driven computerized storehouse of monetary wrongdoing designs. This cooperative organization gives admittance to the most recent AML and extortion typologies, guaranteeing your establishment stays in front of arising dangers.

- Accurately Detect Risk In Real Time With cutting edge man-made intelligence and AI, FinCense guarantees exact and convenient danger identification, defending your resources and notoriety. Our framework flaunts more than 90% exactness progressively location and avoidance of dubious exercises.

- Scale Seamlessly FinCense’s strong, present day information innovation stack empowers quick sending and versatility across your endeavor.

Revolutionise Your AML Compliance with FinCense

- 100% Risk Coverage for AML Compliance

Accomplish 100 percent risk inclusion for all AML consistence situations by utilizing Tookitaki’s AFC Environment, guaranteeing thorough and modern security against monetary wrongdoings. - Reduce Compliance Operations Costs by 50%

Influence FinCense’s AI abilities to decrease misleading up-sides and spotlight on material dangers, radically further developing SLAs for consistence detailing (STRs). - Achieve Unmatched 90% Accuracy in AML Compliance

Our computer based intelligence driven AML arrangement guarantees continuous identification of dubious exercises with more than 90% exactness.

Protect Your Financial Institution with Advanced Fraud Prevention

- Real-Time Fraud Prevention

Screen clients and forestall exchange misrepresentation progressively with Tookitaki’s high level simulated intelligence, accomplishing 90% precision for powerful and solid extortion assurance. - Comprehensive Risk Coverage

Use progressed artificial intelligence calculations and AI to guarantee complete extortion recognition, covering all potential gamble situations. - Seamless Integration and Efficiency

Effectively incorporate with existing frameworks to smooth out tasks and permit your consistence group to zero in on critical dangers.

Our Solutions

TRANSACTION MONITORING

- Influence the AFC Environment for 100 percent inclusion utilizing the most recent typologies from worldwide specialists.

- Screen billions of exchanges progressively to actually alleviate extortion and tax evasion chances.

- Use a mechanized sandbox to test situations, diminishing arrangement exertion by 70% and cutting misleading up-sides by 90%.

ONBOARDING SUITE

- Screen different client credits progressively like name, address, orientation, date of birth/fuse and that’s only the tip of the iceberg, decreasing misleading up-sides by 90%.

- Get exact gamble profiles for a large number of clients progressively with comprehensive pre-designed rules on KYC information.

- Incorporate flawlessly with KYC/onboarding frameworks utilizing continuous APIs.

SMART SCREENING

- Guarantee administrative consistence by precisely matching clients against authorizations, Kick, and Unfriendly Media records in 25+ dialects.

- Utilize pre-bundled or custom watchlist information, and effectively test and send new designs with the underlying sandbox, diminishing exertion by 70%.

CUSTOMER RISK SCORING

- Settle on informed choices with exact client risk profiles in view of Client, exchange, organization, Counterparty information and then some.

- Envision stowed away dangers and complex associations with network representation.

- Accomplish exact 360-degree risk profile utilizing a unique gamble motor with unaided and directed models, and influence 200+ pre-designed rules with the adaptability to add custom guidelines for business-explicit dangers.

SMART ALERT MANAGEMENT

- Utilizing strong computer based intelligence motor diminish misleading up-sides by up to 70% utilizing progressed AI models.

- Benefit from a self-learning instrument that keeps up with high exactness over the long run, and a logical computer based intelligence structure for straightforward ready investigation.

- Consistently coordinate with existing frameworks utilizing normalized information models and underlying connectors for quicker go-live.

CASE MANAGER

- Access all significant case data in a single spot with cautions totaled at a client level. Research clients, not individual cautions.

- Robotize STR report age and oversee okay cautions productively.

- Accomplish a 40% decrease in examination taking care of time while acquiring constant perceivability of cautions and case lifecycle with a powerful dashboard.